- Gold eased below $4,000 as traders booked profits following record highs, easing geopolitical tensions.

- Persistent policy instability and growing inflation concerns reaffirm gold’s safe-haven appeal.

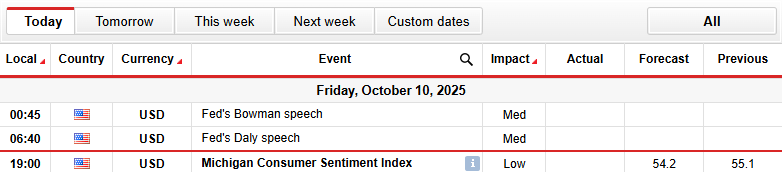

- Traders closely monitor Fed speeches and the Michigan Consumer Index for further policy and direction cues.

The gold outlook shows a pause in the uptrend, correcting below the $4,000 mark as traders took profits after the recent record highs above $4,060. The retreat stemmed from easing geopolitical tensions after the US negotiated a ceasefire between Israel and Hamas. The risk sentiment has improved, reducing safe-haven demand. Despite this pullback, the medium-term outlook for gold stays positive due to support from several macroeconomic factors.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

From the US, lingering uncertainty regarding the interest rate keeps XAU/USD on edge. Although the dollar edged higher this week, expectations of the Federal Reserve continuing its easing cycle amid the declining employment data and persistent inflation concerns continue to cap downside risks.

The ongoing US government shutdown, Fed rate-cut bets, and European political instability support gold prices. Investors continue to pursue safety against policy and fiscal uncertainty.

Additionally, the central banks’ purchase of gold, rising inflation, and declining confidence in traditional currencies have increased prices. The ongoing geopolitical tensions, such as Russia-Ukraine friction and trade worries, maintain the safe-haven demand while offsetting the optimism from the Gaza ceasefire.

Despite intermittent profit-taking, analysts expect the gold correction to be modest as it safeguards against economic cost pressures and policy uncertainty. A favorable macroeconomic demand and a steady investor interest in safety support gold.

Gold Key Events Ahead

- Fed’s Bowman speech

- Fed’s Daly speech

- Michigan Consumer Sentiment Index

Traders are looking ahead to the Fed’s Bowman and Daly speeches and the Michigan Consumer Sentiment Index for insights into the expectations for the US monetary policy.

Gold Technical Outlook: Stabilizing Under $4,000 within Uptrend

The XAU/USD 4-hour chart suggests the price is stabilizing after a strong rally. It trades near $4,000, at the time of writing, after dipping to $3,950 overnight. The metal remains above the key MAs except the 20-period MA. The support level for gold lies around 50-MA near $3,930, followed by 100-MA at $3,832, and the 200-MA near $3,694. These imply that the broader uptrend stays firm.

–Are you interested to learn more about forex signals? Check our detailed guide-

The RSI stays near 65. While it indicates a positive momentum, it also hints at possible overbought conditions if the rally persists. A steady break above $4,000 could trigger further upside, with immediate resistance at all-time highs near $4,060 ahead of $4,100.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.