- The GBP/USD weekly forecast shows a strong US labor sector.

- US jobs data pointed to a faster-than-expected economic decline.

- The US added 177,000 new jobs in April.

The GBP/USD weekly forecast is slightly bearish as strong US labor sector validates the Fed’s cautious tone.

Ups and downs of GBP/USD

The GBP/USD price ended the week down after climbing to new highs. Initially, the pound rallied against the dollar amid downbeat US economic data. However, this changed after robust employment figures at the end of the week.

-Are you looking for forex robots? Check our detailed guide-

US figures on job vacancies, pirate employment and jobless claims pointed to a faster-than-expected economic decline. However, business activity in the manufacturing sector was better than expected. Moreover, the nonfarm payrolls report revealed 177,000 new jobs in April compared to estimates of 138,000.

Next week’s key events for GBP/USD

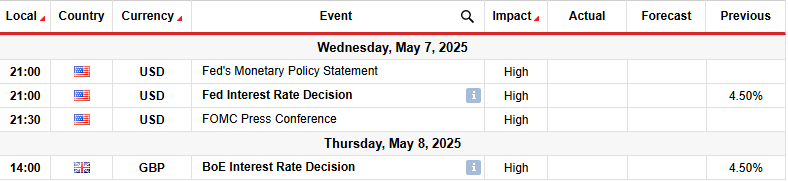

Next week, market participants will focus on the Fed and Bank of England policy meetings. Economists expect the Fed to keep interest rates unchanged, while the Bank of England will likely cut rates by 25-bps.

The Fed has maintained a cautious tone, with Powell saying there was no hurry to cut interest rates. However, recent downbeat economic data might push the central bank in June. Meanwhile, the BoE is aware of the likely impacts of Trump’s tariffs. Weaker global and UK growth will likely push policymakers to consider a faster easing cycle.

GBP/USD weekly technical forecast: Uptrend pauses after recent swing high

On the technical side, the GBP/USD price has paused after reaching the 1.3401 key resistance level. Moreover, the price trades above the 22-SMA and the RSI is above 50, suggesting a bullish bias. GBP/USD has maintained a bullish trend, making higher highs and lows. At the same time, the price has respected a trendline as support.

-Are you looking for the best CFD broker? Check our detailed guide-

The most recent swing started at the support trendline and the 1.2702 level. However, the move slowed near the 1.3401 level. Bulls tried twice to break above the level but failed. Meanwhile, the RSI made a slight bearish divergence, signaling a looming pullback.

The price might be ready to retest the 22-SMA. A deeper retreat would retest the support trendline. The bullish bias will remain if the price stays above the SMA or the trendline. Meanwhile, the uptrend will continue with a break above the 1.3401 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.