- The GBP/USD weekly forecast is optimistic after the US-UK trade deal.

- Some BoE policymakers were not ready to cut interest rates.

- The dollar had a solid week due to optimism about easing trade tensions.

The GBP/USD weekly forecast is optimistic, as the US-UK trade deal alleviates concerns about growth in Britain.

Ups and downs of GBP/USD

The GBP/USD pair had a bullish week but closed below its highs due to dollar strength. The pound had a good week after the US signed a trade deal with the UK, leaving a baseline tariff of 10%. Moreover, the BoE policy meeting revealed that some policymakers were not ready to cut interest rates. As a result, rate cut expectations dropped.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

However, the dollar also had a solid week after the Fed remained cautious and due to optimism about easing trade tensions. The US-UK deal opened the door for a US-China deal.

Next week’s key events for GBP/USD

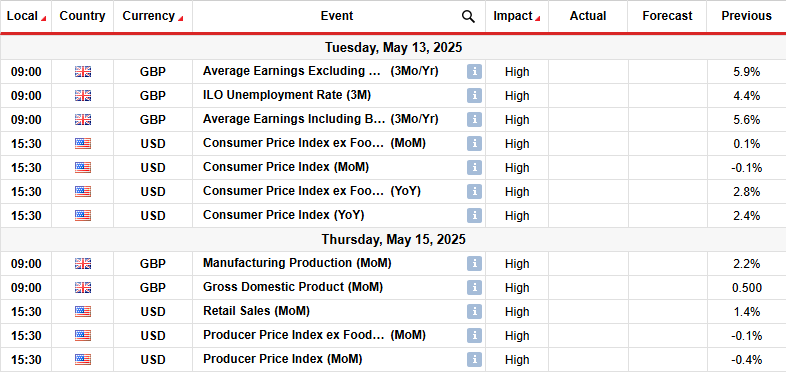

Next week, market participants will focus on data from the UK, including employment, manufacturing production, and GDP. Meanwhile, the US will release figures on consumer inflation, retail sales, and wholesale inflation.

The UK employment and GDP reports will shape the outlook for future Bank of England policy moves. Upbeat numbers will lower expectations for rate cuts, supporting the pound. On the other hand, cracks in the economy would pile pressure to cut rates.

The same will happen in the US with inflation and sales data. Higher inflation and weak sales would reflect the impacts of Trump’s tariffs.

GBP/USD weekly technical forecast: Bulls retest the SMA line

On the technical side, the GBP/USD price has pulled back to retest the 22-SMA support after pausing near the 1.3401 resistance level. Despite the pullback, the price looks ready to bounce higher. It trades above the SMA, and the RSI is above 50, supporting a bullish bias.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

GBP/USD has maintained a bullish trend for some time, despite puncturing the 22-SMA. At the same time, it has respected a support trendline below the SMA, bouncing to new highs from the line. The most recent high came near the 1.3401 key level. Here, the price paused to consolidate as the SMA caught up.

Given the strong bullish bias, the price might break above 1.3401 next week for a higher high. Such a move would allow bulls to target the 1.3603 key level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.