- The AUD/USD weekly forecast points to a likely RBA rate cut on Tuesday.

- Markets interpreted Trump’s Fed replacement as dovish.

- US unemployment claims rose, fueling concerns about the labor market.

The AUD/USD weekly forecast points to a likely RBA rate cut on Tuesday that could drag the Australian dollar lower.

Ups and downs of AUD/USD

Last week, the AUD/USD pair ended green as the dollar fell due to an increase in Fed rate cut expectations. The dollar extended its declines from the previous Friday, when the US released a downbeat nonfarm payrolls report. At the same time, markets interpreted Trump’s replacement in the Fed as dovish. Additionally, they expect Trump to replace Powell after his term ends with a more dovish Chair.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Meanwhile, data during the week revealed weaker-than-expected business activity in the US services sector. Separately, unemployment claims rose, fueling concerns about the labor market.

Next week’s key events for AUD/USD

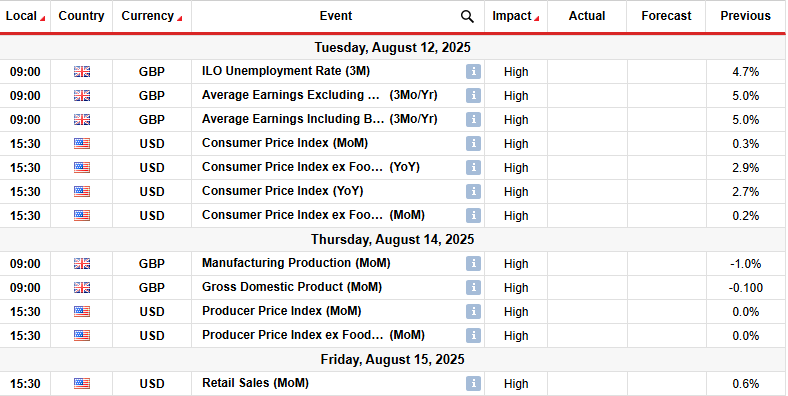

Next week, market participants will focus on the Reserve Bank of Australia policy meeting and employment figures from Australia. Meanwhile, the US will release figures on consumer and wholesale inflation. Moreover, traders will focus on the US retail sales report.

Market participants expect the RBA to cut rates on Tuesday by 25-bps. Additionally, they expect one more rate cut this year. Therefore, they will focus on the messaging during the meeting. On the other hand, the US inflation data will continue to shape the outlook for Fed rate cuts.

AUD/USD weekly technical forecast: Bulls challenge SMA resistance within consolidation

On the technical side, the AUD/USD price has paused near the 22-SMA resistance after bouncing from the 0.6425 key support level. Moreover, the price has remained in a sideways move between the 0.6425 support and the 0.6600 resistance levels.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Bulls have struggled to maintain their position above the 22-SMA. However, after the last range resistance touch, bullish momentum was weaker, and bears made a significant swing below the SMA. Nevertheless, it was not enough to start a downtrend.

Bulls returned at the range support and pushed the price to retest the SMA. A break above will allow bulls to retest the range resistance. On the other hand, if the SMA holds firm, the price will likely bounce lower to try to make a lower low. Such an outcome would confirm the start of a bearish trend. Additionally, it would clear the path to the 0.6201 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.