- The AUD/USD weekly forecast points to a more dovish Fed and a more cautious RBA.

- Fed policymakers took on a more dovish tone.

- Inflation in Australia jumped by 2.8%.

The AUD/USD weekly forecast points to a more dovish Fed and a more cautious RBA, which is supporting the Aussie.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week as the dollar fell amid bets of a Fed rate cut in September. At the same time, the Australian dollar strengthened after data revealed hotter-than-expected inflation in Australia.

–Are you interested in learning more about forex indicators? Check our detailed guide-

The greenback remained subdued this week as Fed policymakers adopted a more dovish tone, boosting expectations for a rate cut. John Williams and Christopher Waller supported a likely rate cut in the near future. However, traders remained cautious ahead of the nonfarm payrolls report.

At the same time, data revealed that inflation in Australia jumped by 2.8%, bigger than the forecast of 2.3%, leading to a decline in RBA rate cut expectations.

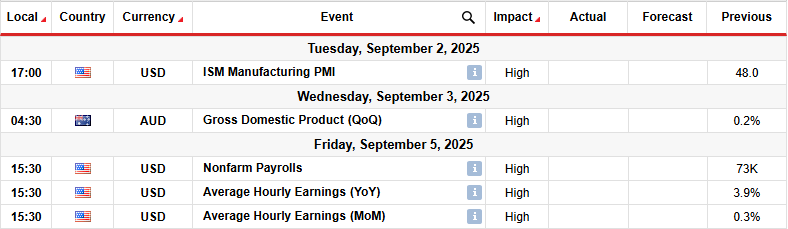

Next week’s key events for AUD/USD

Traders will focus on key reports from the US, including manufacturing business activity and the nonfarm payrolls report. Meanwhile, Australia will release its GDP report, which will provide an update on the state of the economy.

The upcoming US economic data will shape the outlook for Fed rate cuts. Already, market participants are pricing an over 80% chance of the central bank cutting rates in September. More downbeat figures, especially in the labor sector, will increase this likelihood and weaken the greenback. On the other hand, positive numbers could ease pressure on the Fed to lower borrowing costs.

Meanwhile, Australia’s GDP might also shift the outlook for Reserve Bank of Australia rate cuts.

AUD/USD weekly technical forecast: Bulls prepare to retest the range resistance

On the technical side, the AUD/USD price trades above the 22-SMA, with the RSI above 50, indicating a bullish bias. However, on a larger scale, the price is caught in a sideways move between the 0.6425 support and the 0.6600 resistance level.

–Are you interested in learning more about next cryptocurrency to explode? Check our detailed guide-

Bulls took over by pushing the price above the 22-SMA. However, it soon got caught in a consolidation, chopping through the 22-SMA with no clear direction. Within the range, the bullish bias is strong. This means that the price will likely soon retest the range resistance. A break above would strengthen the bullish bias and continue the previous move. However, if the level holds firm, the price will remain in a consolidation phase. Bears might take over to challenge the range support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.